Uranium Play: Pegasus Resources Stock (PEGA.V)

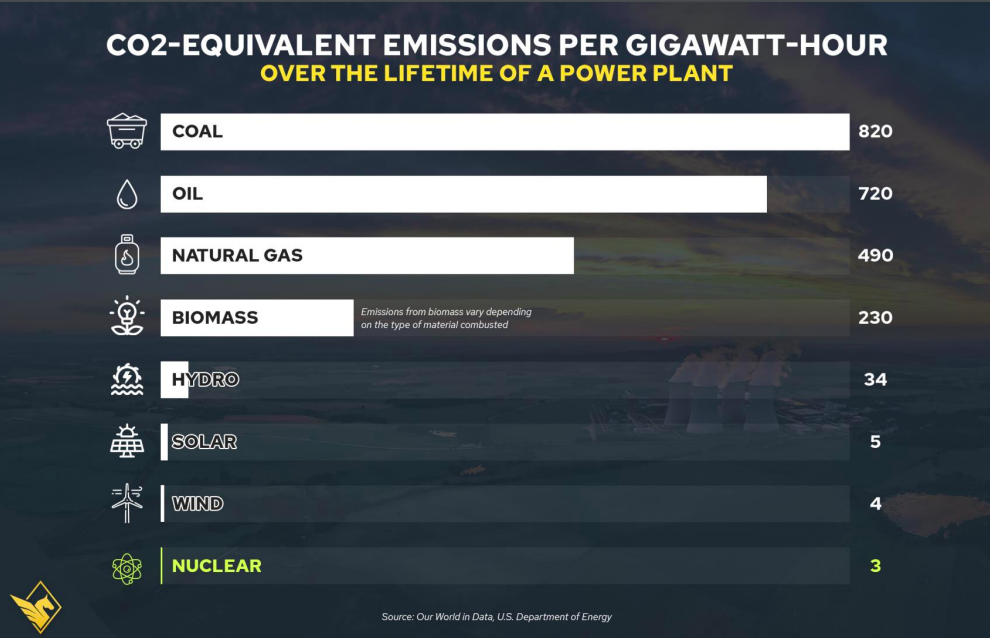

Pegasus Resources stock (PEGA.V) is an exciting play as nuclear power has a unique spot in transitioning from fossil fuels to sustainable energy. Nuclear energy can provide baseload power without the environmental damages that coal or natural gas emissions produce. It is also a stable energy source compared to solar and wind energy, which varies. Mining uranium can raise concerns as it could cause environmental damages if not done correctly, but Pegasus Resources will erase all of these concerns. Pegasus Resources Inc. is a diversified Junior Canadian Mineral Exploration Company focusing on uranium, gold, and base metal properties in North America.

Nuclear will Power the Future

According to the International Atomic Energy Agency (IAEA), the high case projection has global nuclear-generating capacity increasing from 392 GWe in 2019 to 475 GWe by 2030, 622 by 2040, and 715 by 2050. Choosing nuclear options can result in several cases, whether it be for environmental or electric freedom. Recently, European countries are suffering from energetic dependency as many countries bought Russia’s resources. For example, an eraser-sized uranium pellet contains the same energy as 120 gallons of oil or 17,000 cubic feet of natural gas. This allows nuclear power plants to efficiently generate large amounts of electricity, making them one of the cleanest energy sources per GWh of electricity produced. Uranium can produce tremendous energy and has one of the lowest CO2 emission ratios being environmentally beneficial.

Pegasus currently holds four Uranium properties located northeast of the prolific Athabasca Basin of northern Saskatchewan:

- The Wollaston Northeast Property: located about 45 km northeast of the Eagle Point Uranium Mine;

- The Bentley Lake Property: located approximately 35 km northeast of the edge of the Athabasca Basin.

- The Mozzie Lake Property consists of two claim blocks situated approximately 25 and 40 km northeast of the edge of the Athabasca Basin.

The company owns plenty of other projects including:

- the Energy Sands Project: the project consists of sandstone-hosted uranium and vanadium mineralization with demonstrated potential to establish resources;

- the Golden Project: the project features three properties located along the British Columbia – Alberta border;

- the Millionara Project: the property is approximately 25 km northwest of the Jerritt Canyon Gold Mine, recently purchased by First Majestic Silver Corp. in a $470 million-plus share deal. Jerritt Canyon has produced over 9.5 million ounces of gold since 1981.

Recently as of April 7th, the company announced the hiring of Dahrouge Geological Consulting Ltd to manage the field exploration work on the newly acquired Energy Sands Uranium Project located in Emery County, Utah.

Share Structure/Fundamentals

PEGA’s fundamentals represent junior minings’ standards. The company has 90.5M shares outstanding, 9M options, and 23.8M warrants, leading to 123M shares fully diluted.

According to their latest financial statement, the company seems to be low on cash as they reported $138k in cash. PEGA has $2.6M in total assets for $1M in liabilities.

Most warrants have an exercise price of $0.05, $0.06. It is positive because the company has the leverage to exercise them as its share price is above them. There are many exercise prices concerning the options, going from $0.05 to $0.50. It is exciting because the $0.50 options expire in April 2024, meaning the company is confident in its operations.

Insiders make no significant trades. In February 2022, Dave Bissoondatt (Director) exercised 250k warrants at $0.05 for $12.5k worth.

Share Movement

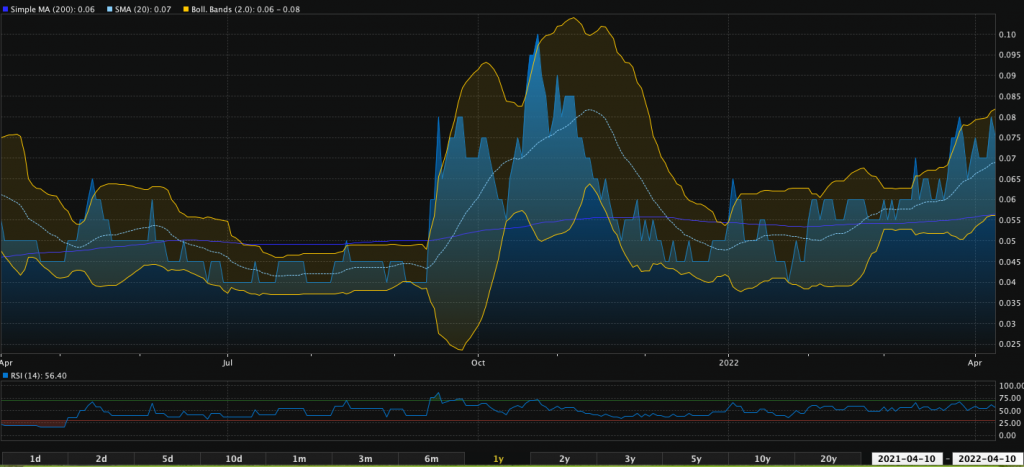

Currently traded at $0.075 for a $7M market cap, the company has a 52-weeks high of $0.10 and a 52-weeks low of $0.035.

The stock is now gaining more traction. Investors accumulate shares, driving the share price up. According to the chart, the stock has been on an uptrend since mid-February, when moving averages crossed. The Simple MA (20) is currently at $0.07, and the Simple MA (200) is at $0.06. We might see the uptrend slow around the $0.10. 549,000 are waiting to be sold through 14 different orders. Besides, it will grant investors to accumulate under the double-digit range. After this resistance, there are no significant walls until the $0.30 range. The Bollinger bands indicate daily fluctuations between $0.06 to $0.08. The last data we can look at is the Relative Stress Index. With a current RSI of 56, the stock price is healthy as it has not reached the oversold or overbought territory.

Even if the volume has been steady for the last couple of weeks (200k average), the stock has had an unusual volume on Friday the 8th, with 384k shares traded, almost double what PEGA usually has.

Bottom Line

Pegasus is the future. Its several projects will bring more value to the company. Jody Dahrouge is a part of PEGA as an advisor who has a successful background in base metals, industrial minerals, rare metals, and uranium exploration. Its market cap is still shallow. With a $7M valuation, the company is far from other companies operating in Athabascan Basin, valued between $20M to $40M. Quant Report gives a fair valuation of $0.13, leading to a 73% direct upside. PEGA is made for you if you want to diversify your portfolio with an emerging company.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?. Moreover, the writer is not involved in PEGA, and does not own shares of the Company .