An intro to Latin Metals Inc (TSXV: LMS.V)(OTCQB: LMSQF)

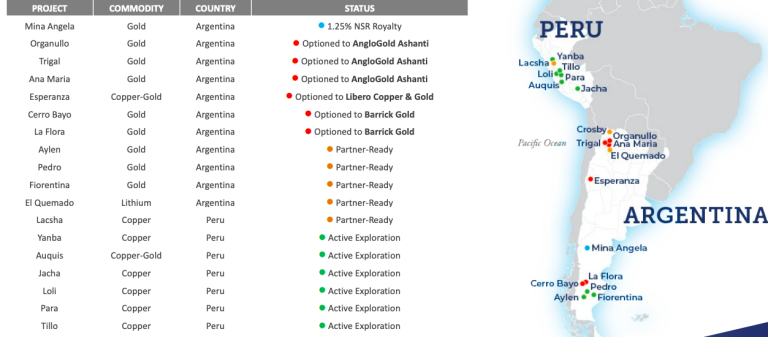

Headquartered in Vancouver, Latin Metals, or LMS, owns a diversified gold and copper exploration assets portfolio in South America.

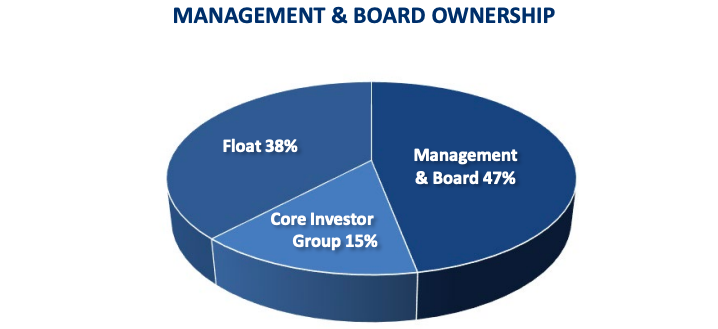

The company secures joint venture partners to fund drilling and advanced exploration and, in doing so, exposes shareholders to the upside of mineral discoveries while conserving capital and minimizing dilution.

It is an excellent opportunity for investors as usually, mining companies dilute their outstanding shares to extend their growth leading to a shareholder’s loss of share value.

How does the company operate?

·Project Generation: technical expertise and experience in project selection;

·Acquire Exploration Properties: exposure multiple commodities/increased probability of discovery;

·Focussed Surface Exploration: low cost of exploration to add value & attract partner interest;

·Secure Partner Funding: secure cash payments, work commitment and minimize dilution to LMS shareholders;

·Partner Funds Exploration: the majority of high-cost exploration and exploration risk born by partners;

·Latin Metals Retain Interests: minority joint ventures interest in future discovery or retained royalty on production.

This is where it is getting interesting

The company is currently building several revenue streams, and the current stock price doesn’t reflect its potential market cap. Latin Metals currently gets 1.25% Net Smelter Royalty from the Mina Angela project, and more is coming. The company optioned six projects and will get benefits:

· LMS will retain 20–25% interest / 2.0% NSR ( Anglogold Ashanti 3 projects);

·LMS will retain 15–30% interest / 1.5% NSR (Barrick Gold 2 projects);

·LMS will retain 30% interest (Libero Gold & Copper 1 project).

On March 10th, Latin Metals updated its previously announced earn-in agreement with Barrick Gold Corporation. Latin Metals granted Barrick the option to earn up to an 85% interest in the three projects located in Santa Cruz Province, Argentina.

Latin Metals and Barrick have agreed with the underlying owner of the Properties as of February 25th, 2022. The underlying owner of the Properties has acknowledged Barrick’s rights under the Earn-In Agreement and authorized Barrick to conduct operations on the Properties. According to the news release: “Barrick is now obligated to incur at least USD 1,000,000 in exploration expenditures on the Properties by the second anniversary of the Effective Date. Latin Metals has now also received the US$150,000 cash payment from Barrick that was due on the Effective Date”.

“We look forward to working with Barrick as it commences its operations under the earn-in agreement[…] Pursuant to the terms of the earn-in agreement, Latin Metals will receive a summary of the operations conducted by Barrick on the properties and the results thereof on a quarterly basis, with the first report scheduled to be delivered to Latin Metals at the end of May 2022.”

Keith Henderson, President and CEO

There currently are 57,295,641 outstanding shares, for 4,605,679 warrants and 6,425,000 options that leads to only 68,326,320 fully diluted. This number is relatively low, the company could do more financing to raise cash, and the fully diluted number can remain considerable.

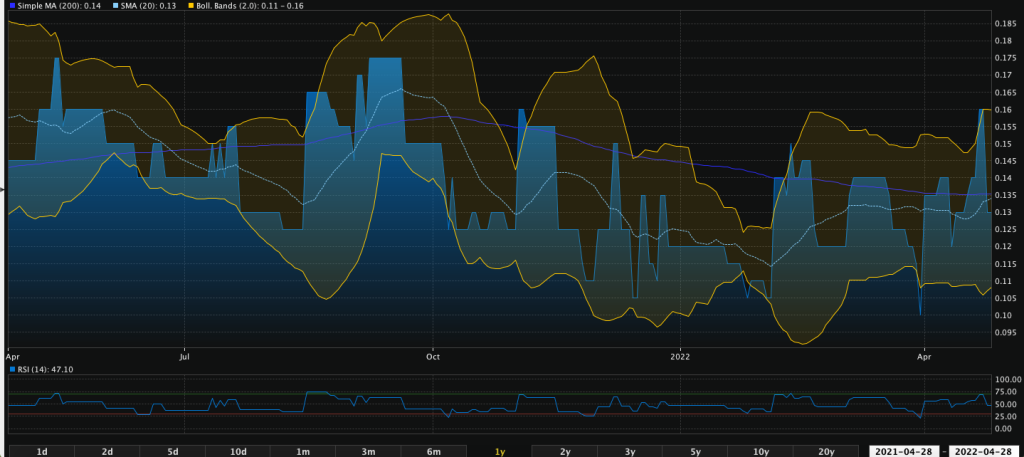

The latest private placement occurred on October 8th to raise $1.3M through the issuance of 8,666,667 units in the capital of the company at a subscription price of $0.15 per Unit, one-half of one common share purchase warrant, with each whole warrant entitling the holder thereof to purchase one share for $0.25 per share.

Bottom Line

The company gathers all the characteristics of a hidden gem. Quants Report gives Latin Metals stock a fair valuation of $0.24, Yahoo Finance and Fundamental Research Corp are even more optimistic with a 1-year target of $0.37.

Investors seemed to look for cryptocurrencies as a safe asset. However, commodities represent the safest sector, and we see more money coming in. Exploration and Mining companies will benefit from this comeback, and Latin Metals will be part of it.

This article solely expresses the opinion of the writer which might be disagreeing with the other writers of Money,eh?. Moreover, the writer is not involved in LMS, and does not own shares of the Company .